Cracking the culture code to transform performance

- dragonfish

- Nov 27, 2017

- 7 min read

Updated: Apr 17, 2019

Originally posted July 2016

Last week the Financial Reporting Council (FRC) published a study which builds a powerful case for the connection between organisational culture and long-term business and economic success.

With such compelling evidence, why isn't every CEO focused on culture as a top priority in the boardroom?

Here is a coffee break synopsis of the FRC report along with four ways that boards need to think differently if they want to transform culture and performance.

The 'Corporate Culture and the Role of Boards Report' is the culmination of the FRC’s Culture Coalition; a collaboration with CIMA, the City Values Forum, IBE, IIA and CIPD, as well as interviews with more than 250 chairmen, CEOs and leading industry experts, from the UK’s largest companies*.

It aims to stimulate thinking around the role of boards in relation to culture, and encourage them to reflect on their current approach. In particular, the report sets out three key elements which boards should be considering in terms of their culture.

Connecting purpose and strategy to culture

“Establishing a company’s overall purpose is crucial in supporting the values and driving the correct behaviours. The strategy to achieve a company’s purpose should reflect the values and culture of the company and should not be developed in isolation. Boards should oversee both.”

Aligning values and incentives

“Recruitment, performance management and reward should support and encourage behaviours consistent with the company’s purpose, values, strategy and business model. Financial and non-financial incentives should be appropriately balanced and linked to behavioural objectives.”

Assessing and measuring

“Boards should give careful thought to how culture is assessed and reported on. A wide range of potential indicators are available. Companies can choose and monitor those that are appropriate to the business and the outcomes they seek.”

So why is this interesting?

The FRC, a UK financial institution responsible for promoting high quality corporate governance and reporting to foster investment, is not only saying that culture is important but, to achieve long-term business and economic success, an organisation has to define and embed a clear purpose. The report stresses that the purpose of an organisation is not merely to satisfy its shareholders but that maximising shareholder value is an outcome of delivering your purpose, not the purpose itself. And that it is, in fact, the responsibility of the board to define a non-financial purpose and then build the right culture to deliver it.

From an independent financial regulator, that’s pretty significant.

And it’s indicative of a growing recognition that culture matters.

There has been a significant shift over the last couple of years with investors demanding more proof that an organisation’s culture is fit for growth.

In a recent study from the FT & EY with FTSE 350 Board Directors**, 92% said that investing in culture has improved their financial performance and 83% said their shareholders now factor organisational culture into their investment decisions.

This is giving HR Directors more influence in the boardroom, and making CFOs more interested in people. With the growing importance of Customer Experience, Marketing Directors are increasingly looking to start building their brand internally, enhancing the link between the employee experience and the customer. We are even seeing functions combine, with the emergence of the Director of HR & Marketing, Director of Colleague and Customer Experience and Chief People and Customer Officer.

The world of work is becoming more complex, and so is the process of managing strong customer relationships. The most progressive companies are seeing culture as the glue that holds all of this stuff together, to drive successful growth.

Companies investing in culture are winning, and CEOs are increasingly coming to terms with the idea that the strength of their culture can make or break their business plan.

So, why aren’t we all busy transforming our cultures?

4 reasons…

1. The cynic in the room

While the FRC report argues, and most leaders would agree, that a strong culture is a source of competitive advantage, most culture change programmes are hindered (or never get past planning stage) by a lack of belief that conventional approaches to employee engagement really do make a commercial difference. In truth, most boards need a bit of convincing that building the right culture is as important as other, more predictable, drivers of business performance. This isn’t helped by a general lack of evidence to support the connections between people, brands, culture and customers that we intuitively know to be true.

It can be confusing, even for the most confident leader, to know where to start with culture alignment, how to secure buy-in from ‘the boss’ or how to measure success in ways that proves this stuff works.

Leaders with ambitious plans to transform culture need to start by ensuring that the entire board has a shared understanding of the role culture development needs to play in helping the organisation achieve its goals. A bit of education goes a long way, and can be delivered with a non-patronising, common sense approach, to ensure any cynics in the room don’t de-rail the programme before you get started.

2. A risk mitigation mindset

A key argument in the FRC report is that culture can mitigate risk and stimulate growth.

“A healthy culture both protects and generates value”.

It’s notable that, with most research of this nature, there is far more emphasis on the former than the latter - value protection over value creation.

Why? Studies based on the views of hundreds of CEOs often come from those who typically have an ‘audit mindset’ - the world’s largest management consultancy or accountancy firms with the time and resource to make this kind of research happen. Whilst this is helpful in lots of ways, it also reinforces the prevailing view that reducing organisational risk is the strongest rationale for investment in culture.

True to form, most rationale in the FRC links to reducing poor corporate behaviour, avoiding reputation damage, and ultimately mitigating risks that could negatively impact shareholder value.

“Poor behaviour can be exacerbated when companies come under pressure. A strong culture will endure in times of stress and mitigate the impact. This is essential in dealing effectively with risk and maintaining resilient performance”

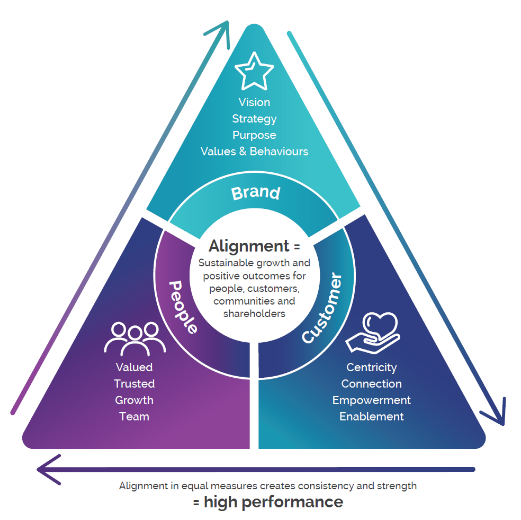

This is all true. However it’s missing the bigger opportunity - the role culture alignment can play in transforming organisational performance. Smart, targeted culture development can go far beyond creating ‘happy staff and good behaviour’, improving performance by identifying and building tangible connections between people, brands and customers.

It is well evidenced that intangible assets, such as intellectual property, customer base and brand, can now account for over 80% of corporate valuations. And culture is an intangible asset.

Boards need to start seeing culture development as an opportunity to enhance the value of their business. Some of the most successful companies in the world are famous for their culture, and very few set out to minimise risk.

3. Seeing (or not seeing) the customer opportunity

The FRC report, like many others, builds an unquestionable case for the connection between culture and financial performance, and provides a range of practical tips and guidance for boards looking for guidance, including:

“Be open and accountable”

“Demonstrate leadership”

“Embed and integrate”

The challenge, however, is that most information that’s currently out there is less clear on specifically how culture affects performance. We’re clear on the why, and the what, but most leaders are left having to guess at the bit that happens in between the inputs and the outputs. We have the academic and theoretical argument, but when asked to explain in real terms how investing in culture will change things, it often becomes a bit hazy.

How does culture actually affect performance?

Clearly, the connection between culture and performance is customers.

These days. If your culture stinks, your customers will know about it. If your people aren’t happy, your customers will feel it. If your people aren’t effective, your customers will tell you about it.

If ‘people challenges’ exist, they start to effect customer retention, faster than ever and in a very real way.

Conversely, if your culture creates high performing, effective teams, your customers will thank you for it. If your people love your brand, your customers will love you for it.

Organisations are more transparent than they have ever been, work is more complex and media is more immediate. So, increasingly leaders are having to reconsider the connections between their people and their customers, and the role that culture development has to play.

More than ever, boards need to ask themselves whether their culture is fit for their customers.

4. Getting to grips with intangibles

The inherent difficulties with culture change lie in understanding, shaping and measuring intangibles, along with the challenge of obtaining a realistic view of the culture at the coalface. These are two common problems faced by boards across all sectors.

“The key challenge for the board is to understand what in practice drives the behaviour of employees and management and to shape and influence those drivers in a way that will foster greater sustainability and improved performance over time”

In other words culture change can seem too complex, a bit ‘fluffy’, and at times a bit of a mystery. It is too easy for culture to be put into the ‘too difficult’ box, or seen as someone else’s job.

The opportunity for progressive leaders, with ambitious growth plans, is to demystify culture. Make it all less ‘fluffy’ and more tangible for their peers tasked with improving results. To see developing their culture as a lever they can pull to affect performance - and know how to pull it. Something as tangible as increasing advertising spend or cutting overheads.

There is no reason why the culture plan shouldn’t be as straight forward as the advertising plan, or why employee data can’t be as useful as customer data. However, boards need more data-led methodologies for making culture and people engagement more tangible, more objective and less academic. Going beyond the annual employee engagement survey to robust diagnostic approaches that identify the employee engagement factors in their business that most drive the business outcomes they need, size the positive impact of targeted solutions and provide objective planning and evaluation frameworks for improving people engagement and performance.

Culture can be understood, shaped and measured, to drive major performance improvements in areas that matter. When sufficient time and thought is given to defining the culture your organisation needs to win, the business case becomes a no brainer.

About Dragonfish

Dragonfish is culture and engagement consultancy with offices in London, Southampton, Sydney and LA. We work with senior leaders in large organisations with ambitious plans to transform culture and performance. If that sounds like you, and you’re interested in an informal discussion please email tina.hennessey@dragonfishuk.com.

Sources

* Corporate Culture and the role of boards: Report of Observations, July 2016

About the study

The report is the culmination of the FRC’s Culture Coalition, a collaboration with CIMA, the City Values Forum, IBE, IIA and CIPD , as well as interviews with more than 250 chairmen, CEOs and leading industry experts, from the UK’s largest companies. The report explores the importance of culture to long-term value and how corporate cultures are being defined, embedded and monitored.

** Is your board yet to realise the true value of culture?

About the study

In H1 2016, FT Remark in partnership with EY surveyed 100 board members at FTSE 350 companies across a wide range of sectors; 60 in executive and 40 in non-executive roles. Job titles include CEO, CFO, chairman and non-executive director. Fifty of those surveyed were from FTSE 100 companies. The survey included a combination of qualitative and quantitative questions and all interviews were conducted over the telephone by appointment. Results were analysed and collated by FT Remark and all responses are anonymised and presented in aggregate.

Comments